Medtech by the Numbers

Read this article on MedTech Strategist

MedTech by the Numbers

by Mary Stuart

On a panel at MedTech Strategist’s Innovation Summit in Dublin, seasoned venture capitalists gave us their take on the abysmal medtech investment statistics for 2023 and what strategies they dictate for companies looking for funding and for their own funds going forward.

Each year, at MedTech Strategist’s Innovation Summit in Dublin, we present “MedTech by the Numbers,” a panel session where we ask VCs to identify trends inherent in the previous year’s investment and M&A activity. At this year’s summit in April, Jennifer McMahon presided over the panel. A partner at Seroba, which invests in biotech and medtech with a main concentration in Europe (and with a reach to North America), McMahon brought together four VCs with different perspectives, although all invest in medtech to some degree.

Inga Deakin, a principal at a London-based Molten Ventures, offered the perspective of the specialist healthtech investor in a generalist fund. Founded in 2006, Molten is a publicly traded venture fund that invests across digital health, enterprise software, deeptech, healthtech, and tools for life sciences. The company doesn’t invest in drugs development and rarely invests in traditional medical device companies before clinical or regulatory approval.

Megan MacDonagh brought a medtech focus as a vice president at the long-running SV Health Investors, overseeing its MedTech Convergence Fund from New York, although she hails from Galway, Ireland.

Amsterdam-based Anne Portwich is a former Scientist with a PhD from the Max Planck Institute and a partner at the EQT Life Sciences (formally LSP, one of Europe’s largest and most experienced healthcare investors, with a track record going back 30 years). Portwich is a part of the team that works on the EQT Health Economics strategy, which invests in medical devices, diagnostics, and digital health. Her focus is on medtech.

Rounding out the panel is Sylvain Sachot, PhD, a partner at Barcelona-based Asabys Partners. Asabys invests broadly across healthcare, including biopharma, diagnostics, and digital health. Asabys is currently investing from a €150 million fund, its second, and will allocate half its funds to medtech, mainly in Europe.

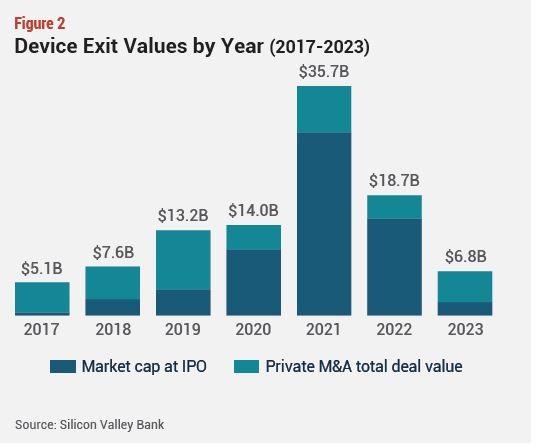

To set the stage for the discussion, we consulted Silicon Valley Bank’s (SVB) 2023 annual report, “Healthcare Investments and Exits,” covering biopharma, healthtech, diagnostics, and medical devices (see figures 1 and 2). 2023 saw a continuation of the decline – for medtech, in deal volume, size of funding rounds, and valuations – that began after a peak year in 2021. The phenomenon wasn’t limited to medical devices, however. According to the SVB report, taking into account all healthcare sectors, the level of investment was down 55% from the 2021 peak, and on the whole, the IPO market was flat, compared to 2022.

Venture capital allocated specifically to device companies (in both the US, EU, and UK) dropped off by 25%, as compared to the previous years, and diagnostics and tools struggled even more to get funding, receiving 42% less capital, year on year. In the medical device sector, Series A rounds were fewer, smaller, and valued the company less than the previous year; 142 early-stage rounds raised $684 million in 2023, compared to 137 medtech deals in the previous year, which garnered $971 million. And the median seed/Series A pre-money valuation was down in 2023.

Are we simply seeing a reset, after a spike in 2021 that contributed to overinflated valuations, or are we heading into a new normal that calls for stoicism and creative problem-solving, or both? There was no better opportunity to hear answers to these questions from a group of investment experts at the panel session moderated by McMahon.

Anne Portwich, EQT Life SciencesWe have to move to a place where early-stage investors are rewarded, because otherwise the system doesn’t work.

The View From the Trenches

SV Health’s Megan MacDonagh noted that although medtech investment is down from the last few years, “it is in line with pre-pandemic levels.” In the past two years, more companies raised rounds due to an influx of new capital into healthcare spaces, and now we’re just experiencing a recalibration, she said. “Overall, I think the system is as healthy as it was in the years leading up to the pandemic.”

Anne Portwich, whose firm invests both in Europe and the US, with a greater emphasis on Europe, finds that deal flow is as good as it has ever been. “We see a lot of interesting opportunities and a lot of companies that are hurting for money.” The scarcity of funding specifically for medtech right now gives EQT many opportunities for investments, she said. But that also presents a challenge for supporting portfolio companies because there are so many companies in need of funding.

McMahon polled the panellists as to their current preference for investment stage, in light of the pre- and post- pandemic landscape.

Asabys’ strategy hasn’t changed, according to Sylvain Sachot, who said that today, as always, it’s a matter of addressing particular opportunities and balancing the portfolio. “With more medtech companies asking for capital when there aren’t that many funds dedicated to medtech, it is easier for us to invest as we wish.” And although it is tempting to invest later, when the holding time is shorter, and all the risks except for commercial development have been removed (Asabys is looking at a couple of such opportunities, he pointed out), Sachot said, “You can’t just invest in already developed technology. It is exciting to invest in new science, earlier, and at a lower valuation. It’s a trade-off and it’s about balancing the portfolio.” Although, McMahon chimed in, “That almost makes it sound like the commercial, sales/revenue round is easier, but to my mind that is the really daunting part, when companies have to prove themselves in the marekt. Where is the bar for ext? $10 million in revenues? $50 million? It is all challenging.”

Asking about the promise of healthtech and AI, McMahon turned to Inga Deakin, since Molten invests across a broad array of tech sectors. According to the SVB report, McMahon noted, in the second half of 2021, healthtech enjoyed a sector high of almost $20 billion invested, while the second half of 2023 saw investment of only about $5 billion.

Deakin belives that 2021 was simply an unusually large spike. “If somebody came in with a life sciences tools company and you had comps like a NASDAQ IPO trading at 30 times revenue, it was easy to write the check. So as an entry group for nonspecialists, that seems like a no brainer.” Removing the spike caused by the “tourists,” Deakin expects the sector to experience steady growth with more reasonable expectations of exits, which, in the majority of cases, won’t be by IPO, she predicts. However, there the challenge is an unclear pathway to exit. The buyer “could be a pharma company, or a Google, or a healthcare system, but the exits aren’t really there to provide the precedents,” she said. For that reason, the nonspecialists that assumed that there would be a frothy software-like tech multiples have left the market.

In 2023, the number of down rounds was up, and the number of up rounds was down. McMahon asked the panellists about the implications of those numbers. “If you are looking at new investments, good for you. But if you are trying t protect your existing portfolio, not so good,” she said.

Deakin noted that across the board there have been more flat and down rounds and repricing events. “Until now, we’ve seen more refinancing, and cost-reduction strategies, particularly for commercial stage companies, which have a few more options.” She then asked, “But even if you can get to profitability, are you really well-positioned for a strategic acquisition, when you’ve de-prioritized growth?”

There was a consensus among the panellists that it is painful to be the bad guy coming in on a down round. Portwich added, “Yes, you can get great opportunities at great valuations, but it is not good for the sector. It leads to the situation that we are seeing today, which is scarcity.” With very few VCs focused on investing in medical devices, there is a chronic shortage of funding. But now, “The scarcity of early-stage medtech funding is a real and growing issue,” she said. “And at some point, the pipeline will dry up and then it will be too late.” VCs are part of the problem, she continued. “We go in late because it is very hard to get a good return when you go in early.”

Portwich elaborated, “We have to move to a place where early-stage investors are rewarded, because otherwise the system doesn’t work.” Angel investors have stepped in to fill the role that institutional investors have traditionally played, she acknowledged, which is valuable, but it can also create highly fragmented shareholder structures, which is a negative for future investors doing due diligence. “And sometimes, when these investors come in and invest at inflated valuations, that is almost a poison pill.” Again, having to be the bad guy that pushes down the valuations, thereby gaining the ire of earlier investors, is a reason to just stay out of the deal, Portwich contends. ” But we do have a real problem. If down is the new normal, then everyone will wait on the side-lines until just before the exit.” She says EQT is trying to create strong syndicates that can carry a company all the way to exit. “We want to create a track record that going in early makes sense. Because at this time, it often doesn’t.

It is important to have people around the table who understand the specific requirements of the medtech business, MacDonagh stressed. “That can be challenging, and that’s the reason [i.e., the temporary entry of nonspecialist investors during the pandemic] for some of these inflated valuations.” She says she always urges entrepreneurs looking for funding to enlist investors who can add value. “Then, when things don’t go as planned, they understand the goal you are working toward and they still believe in you.”

According to Sachot, it is particularly difficult to syndicate during the early-stage right now. He kicked it out to the corporates in the audience: “There is a role here for corporate venture funding to help build the stories that will attract more investors.”

Option deals from corporates appear to be on the rise, McMahon pointed out, and panel members discussed the pros and cons. On one hand, it shows that there is a strategic interested in the company, and it comes with funding, sometimes nondilutive, that a company might not otherwise have been able to access. Sachot added, “It’s a nice way for an acquirer to get in and finance the company with milestones, and historically, at least on the pharma side, 50% of the earnouts are paid.” McMahon continued, “According to data from last year, medtechs were typically even more likely to get their earnouts than pharma companies.” That might have been because the medtech deals were at a later stage than those of pharma, “but there is hope that medtech can become the poster child,” she said.

Portwich cautions that option deals can be a two-sided sword. “There is always a crunch to make the cash last that comes with a change of control, and that creates a vulnerability for the company because that gives the buyer the chance to renegotiate.”

Sylvain Sachot, AsabysThere is a role here or corporate venture funding to help build the stories that will attract more investors.”

Every Reason to Invest

Certainly, current trends illustrate that there are challenges to work through. But wrapping things up on a positive note, McMahon asked each panelist what makes them optimisstic about medtech investing.

Inga Deakin noted, “It might counter the point I made earlier about healthtech having a diversity of acquiror, but each of them is technology hungry, has cash, and is acquisitive. I remain opptimistic that exits will happen.”

Said Sachot, “There is good technoloty, good science, and unmet medical needs. I recently made an investment in a space that was completely uncovered. When you get these technologies in a wide-open market, that is interesting to corporates. These kinds of cases made me optimistic, not the incremental in novation.”

The good word from McDonagh: “The medical needs are there and growing. We have an aging population and we need to bend the cost curve. We see a lot of vibrancy in the market, and a lot of new companies. For the next few years, we just have to get through the challenges of the investment overhang.”

The bright side according to Portwich: “We are seeing a higher quality of entrepreneurs compared to 10 to 15 years ago. I’m seeing relatively early-stage companies that have everything mapped out – the reimbursement, the patient care pathway, the potential acquirers. These days, more often than not, entrepreneurs are able to say ‘Check, check, check, and check.'”